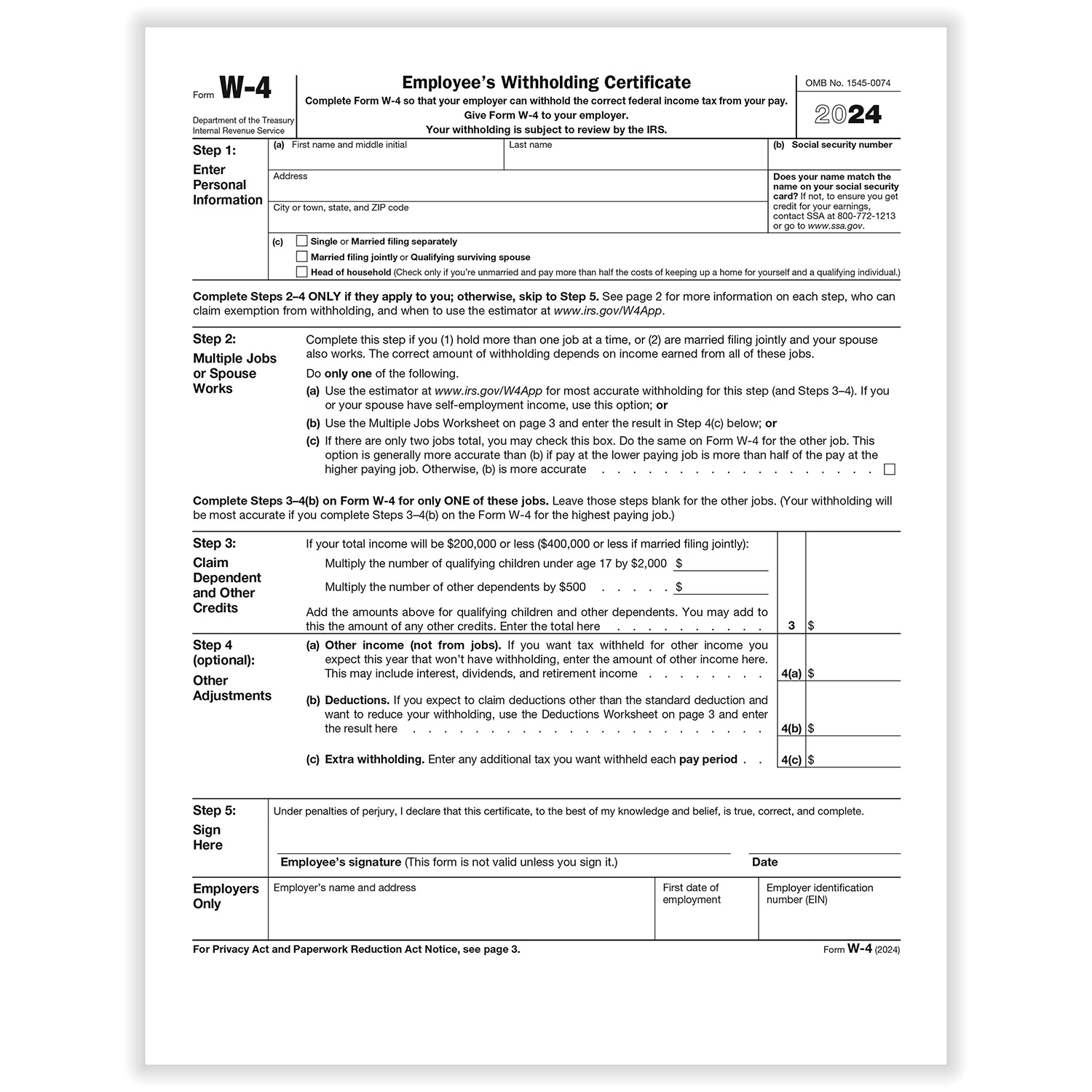

W-4 Form: Employee’s Withholding Certificate

The W-4 form is a document that employees fill out to inform their employer how much federal income tax to withhold from their paycheck. The amount withheld is based on the employee’s filing status, number of dependents, and any additional adjustments they choose to make.

Purpose of the W-4 Form

- Tax Withholding: The W-4 form helps employers determine how much income tax to withhold from an employee’s paycheck. This helps ensure the employee doesn’t owe a large amount of tax at the end of the year or overpay too much and get a refund.

- Filing Status: Employees indicate their filing status, such as single, married filing jointly, or head of household, which affects the withholding amount.

- Deductions and Credits: Employees can adjust their withholding based on tax credits or deductions they expect to claim. For instance, they can request additional amounts to be withheld if they anticipate owing more taxes or fewer withholdings if they expect significant tax deductions or credits.

When to Fill Out a W-4?

- New employees fill out a W-4 when starting a job.

- Employees may also adjust their W-4 form whenever their personal or financial situation changes (e.g., marriage, having children, significant changes in income).

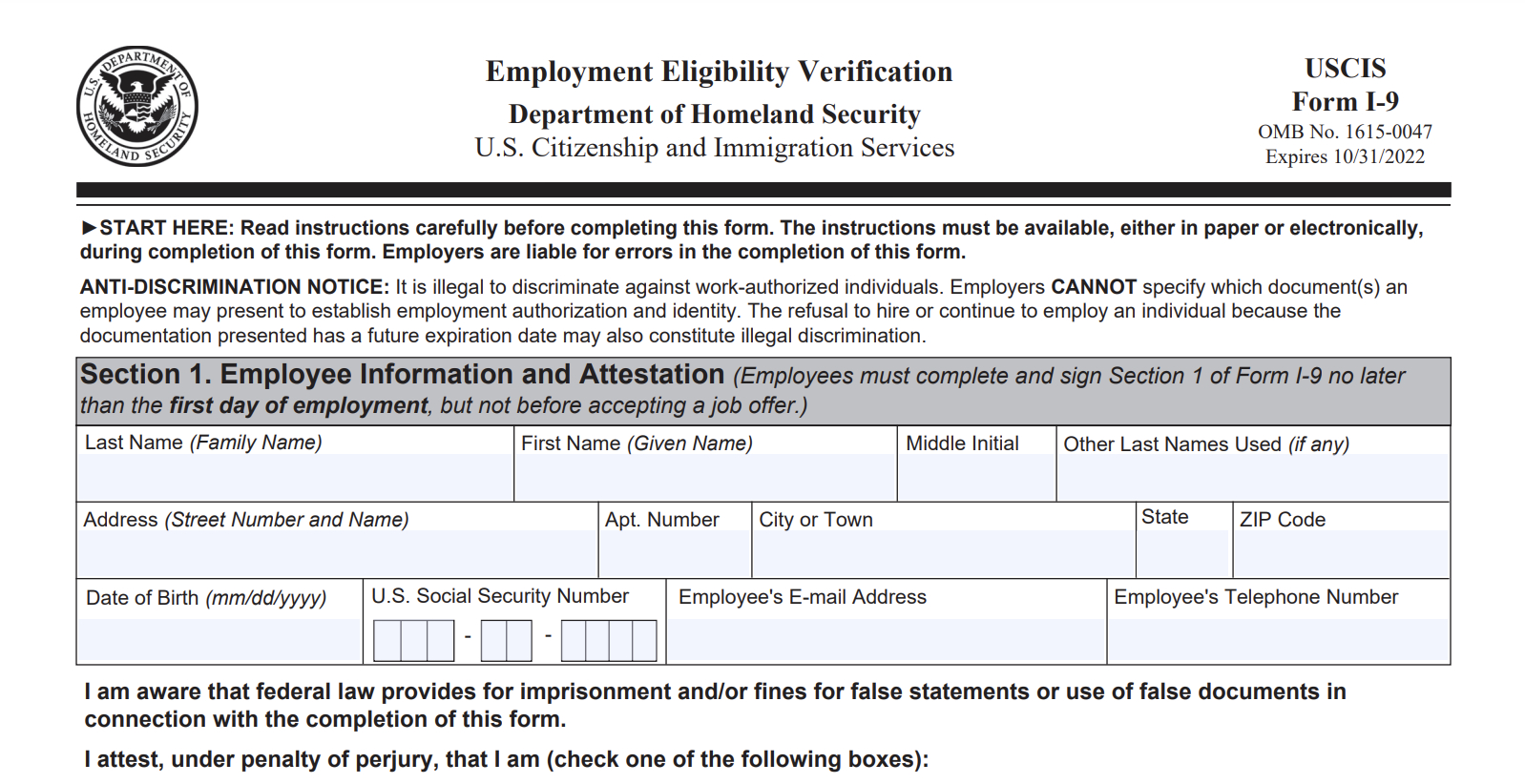

I-9 Form: Employment Eligibility Verification

The I-9 form is used to verify an employee’s identity and legal authorization to work in the United States. It is required by the U.S. Citizenship and Immigration Services (USCIS) for all employees, regardless of citizenship status.

Purpose of the I-9 Form

- Verify Identity and Work Authorization: The I-9 form ensures that the person being hired is legally authorized to work in the U.S. It verifies both the employee’s identity and their eligibility to work.

- Documentation: Employees must provide documentation that proves both their identity and their legal authorization to work in the U.S. This can be one document from List A (proving both identity and work authorization) or one document from List B (proving identity) and one from List C (proving work authorization).

When to Fill Out an I-9?

- All new hires must complete Section 1 of the I-9 form on or before their first day of employment.

- Employers are responsible for completing Section 2 by verifying the documents the employee presents, and this must be done within three business days of the employee’s start date.

Key Differences Between W-4 and I-9 Forms:

- W-4: Related to federal income tax withholding. Helps employers determine how much tax to withhold from an employee’s paycheck based on their tax situation.

- I-9: Related to employment eligibility. Ensures that the person being hired is legally authorized to work in the U.S. and verifies their identity.

Both forms are essential for new employees, but they serve very different purposes—one related to tax withholding and the other related to verifying work authorization.

Images Related to What Are W4 And I9 Forms